Breitbart Business Digest: The Public Demands Action to Fight Inflation

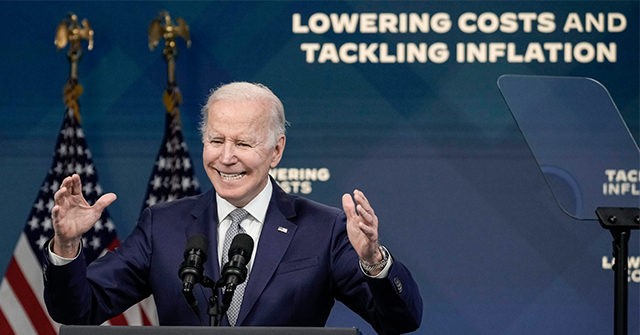

Joe Biden is discovering a political truth that no president has had to confront in decades: Americans hate inflation.

The most recent evidence comes from a CBS News/YouGov poll released Sunday.

The poll found that just six percent of the public think things are going very well in America today, joined by another 20 percent who say things are going somewhat well. Thirty-three percent say things are going somewhat badly, and 41 percent say things are going very badly.

The numbers are similar when it comes to the economy. Six percent say the economy is doing very well, and 20 percent say it is doing fairly well. Thirty percent say the economy is fairly bad, and 39 percent say it is very bad. Five percent say they aren’t sure, which is hardly an endorsement of the Biden administration’s policies. Biden’s overall approval rating is pretty bad, although according to the CBS poll it improved two points to 44 percent in May. On the economy, however, he gets worse marks. Just 36 percent say they approve of Biden’s handling of the economy. When it comes to inflation, just 30 percent approve. Sixty-five percent of the public say Biden is slow to react to important issues, as he quite obviously has been on inflation. Just 45 percent say Biden is fighting hard to address our problems, 57 percent describe the president as distracted rather than focused, and 51 percent say he is incompetent. Given that the Dow Jones Industrial Average just went on the longest losing streak in 90 years, it’s not terribly surprising that Americans are not optimistic about the stock market. Just 33 percent say they are optimistic about stocks. Similarly, only 32 percent say they are optimistic about the national economy. Only 23 percent say they are optimistic about the prices of goods and services, while 77 percent are pessimistic. Fifty-seven percent are pessimistic about their plans for retirement, which makes sense in an atmosphere of rising prices and falling stocks.

The gloominess is all the more extraordinary given the very low level of unemployment and the very high number of open jobs. Even the historically tight labor market only generates a bare majority—52 percent—saying they are optimistic about jobs in their community. Most likely this too is related to inflation. Nearly half of the public seems to understand that the Federal Reserve’s campaign against inflation is likely to come at the cost of higher unemployment.

The centrality of inflation to the public’s pessimism can be seen in the poll’s questions on what issues congressional candidates should focus on. Eighty-three percent say they would like to see Democratic candidates focus on inflation. Eighty-one percent said this should be the focus of Republican candidates. Among Democrats, 89 percent say Democratic candidates should focus on inflation. Among Republicans, 90 percent say their party’s candidates should focus on inflation. Among Trump voters, 94 percent want Republican congressional candidates to focus on inflation. Keep in mind that inflation is not usually considered central to the role of Congress. Mainstream economics generally assigns inflation fighting to the Federal Reserve. It is considered an issue of monetary policy, whereas Congress has authority over fiscal policy. This bout of inflation, however, may be different. It was preceded by an enormous fiscal expansion to fight the effects of the pandemic, and Biden’s $1.9 trillion American Rescue Plan pushed inflation even higher than it would otherwise have been. Perhaps the public is not so much convinced that there’s a lot Congress can do about inflation. Perhaps they just want someone to do something.

The Biden administration’s inept policies have accomplished zilch.

The Fed is badly behind the curve. So, if you ask people what should congressional candidates be focused on, they answer inflation because that’s become the focus of their lives. Everything is getting more expensive, and no one appears to be helping. Republicans should be cautious here.

The poll shows that 51 percent of the public trusts Republicans more than Democrats on the issue of inflation, a razor thin majority. If Republicans want to make an issue of inflation in the midterm elections, they still have some work to do to persuade Americans they have better solutions than the Democrats.

The Fed Says Things Are Great In a different survey, Americans reported the highest level of financial well-being than at any point in almost a decade. This comes from the Federal Reserve’s ninth annual Survey of Household Economics and Decisionmaking, or SHED.

The data, however, is old.

The survey was taken last fall, before inflation hit 40-year highs and when officials were still declaring that it was likely a “transitory” problem. A big part of this well-being stems from the stimulus checks and other measures that inflated bank accounts last year. Seventy-eight percent of adults said they were either doing okay or living comfortably. That’s the highest share since the survey began in 2013. Note, however, that it is only three points higher than in 2020. That seems like a very small amount of progress given the trillions in deficit spending undertaken.

There’s also something a bit off about the Fed’s analysis.

The Fed touts the fact that 68 percent of adults said they could cover a $400 emergency expense exclusively using cash or its equivalent, up from 50 percent when the survey began. This figure partly reflects the fact that $400 just is not what it used to be.

The dollar has lost about a quarter of its value over the last nine years. Something that costs $400 today would have cost around $322.32 back in 2013. To look at it another way, the $400 expense in 2013 would be nearly $500 today. So the Fed thinks it is measuring an improvement in the financial security of American families, but part of this is just inflation. Bostic Still Seems Overly Dovish Atlanta Fed President Raphael Bostic said on Monday that it “might make sense” for the Federal Reserve to pause further interest rate hikes following expected half-point rate increases in June and July. Since there is no meeting in August or October, pausing hikes at the September meeting would mean that the Fed would be putting monetary policy at a standstill for three months.

The idea of a pause is inherently dovish. It shows that Bostic—and likely other Fed officials—is more concerned that the Fed’s actions might slow the economy too much than he is that the Fed’s actions might not get inflation under control. A more balanced approach would be to say that the Fed could pause if inflation falls or it could accelerate if it does not. That was not the message Bostic sent on Monday. It’s also not the message Americans want to hear from the folks who are supposed to be taming the inflation beast.

Read the full article at the original website

References:

- https://www.cbsnews.com/news/americans-economic-concerns-grow-opinion-poll-2022-05-22/

- https://www.breitbart.com/terms-of-use/

- https://www.breitbart.com/privacy-policy/

- https://www.breitbart.com/news/for-americans-2021-delivered-healthiest-finances-in-8-years/

- https://www.federalreserve.gov/newsevents/pressreleases/other20220523a.htm

- https://news.yahoo.com/bostic-baseline-pause-rate-hikes-182233950.html