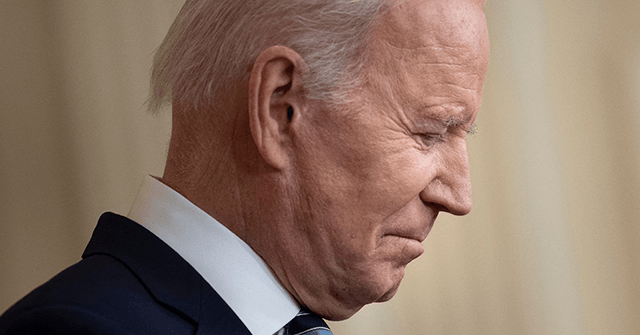

Fact Check: Biden Claims Trump's Tax Cuts Only Benefited The Wealthy

CLAIM: At his first State of Union address, President Joe Biden claimed that Donald Trump’s 2017 tax cut only benefited the top one percent of earners.

“And unlike the $2 Trillion tax cut passed in the previous administration that benefitted the top 1 percent of Americans, the American Rescue Plan helped working people—and left no one behind,” Biden said. Verdict: False.

The beneficiaries of the 2017 tax reforms were not confined to the top earners. In fact, the overwhelming majority of American taxpayers received a tax cut through the Trump Tax Cuts and Jobs Act. Eighty-two percent of American middle-class households received a tax cut and received an average tax cut of $1,260. Ninety percent of Americans saw an increase in take-home pay.

The tax cuts raised wage growth by 3.3 percent and helped foster historic lows in unemployment.

The nonpartisan Tax Policy Center estimated in 2018 that the top 1 percent would get 20.5 percent of the tax cuts. The top twenty percent would get 65.3 percent. Higher-income people pay most of the income tax so cuts to income taxes tend to benefit them.

The top twenty percent of households, for example, earn 53 percent of pre-tax income and pay 68 percent of all income taxes, according to the Peter Peterson Institute. If the tax cuts for the middle class are allowed to expire in 2027—something that most analysts think is unlikely—then the cuts will indeed skew much more toward the rich. According to the Tax Policy Center, after the expiration, the top 1 percent would enjoy 82.8 percent of the benefits. Indeed, the lopsidedness of this burden is one of the reasons few expect the middle-class cuts will be allowed to expire. But that is not what Biden claimed. He claimed that the tax cuts went exclusively to the wealthy, which is false. This is a falsehood that Biden has been telling since he was running for office. He repeated it a year ago at his first press conference.

Read the full article at the original website

References:

- https://nam03.safelinks.protection.outlook.com/?url=https%3A%2F%2Fwww.taxpolicycenter.org%2Fpublications%2Feffect-tcja-individual-income-tax-provisions-across-income-groups-and-across-states%2Ffull&data=02%7C01%7C%7C57ada033221f4f63541908d74f10b9f7%7C4a082c81950a410d9618462a9c74d6ae%7C1%7C0%7C637064805597050835&sdata=K3ZDYYA%2FSHTWZB4z7gVUhim5AmJZlzugzoZlzSfpR2g%3D&reserved=0

- https://nam03.safelinks.protection.outlook.com/?url=https%3A%2F%2Fwww.taxpolicycenter.org%2Fpublications%2Feffect-tcja-individual-income-tax-provisions-across-income-groups-and-across-states%2Ffull&data=02%7C01%7C%7C57ada033221f4f63541908d74f10b9f7%7C4a082c81950a410d9618462a9c74d6ae%7C1%7C0%7C637064805597060838&sdata=%2Fj3tt%2BIJjSG7grSpX7W%2FR%2FKoRyZD7%2Bor6crUPZqxgDg%3D&reserved=0

- https://nam03.safelinks.protection.outlook.com/?url=https%3A%2F%2Fwww.cnbc.com%2F2019%2F01%2F04%2Fnonfarm-payrolls-december-2018.html&data=02%7C01%7C%7C57ada033221f4f63541908d74f10b9f7%7C4a082c81950a410d9618462a9c74d6ae%7C1%7C0%7C637064805597070832&sdata=R8u9f7z55wJhJ5SGVrz5S9zIbzkN2o6tT3rzNCrwAh0%3D&reserved=0

- https://www.taxpolicycenter.org/publications/distributional-analysis-conference-agreement-tax-cuts-and-jobs-act/full

- https://www.pgpf.org/budget-basics/who-pays-taxes#:~:text=The%20U.S.%20Tax%20System%20Is%20Progressive&text=CBO%20estimates%20that%20the%20top,goes%20to%20the%20bottom%20quintile.

- https://www.breitbart.com/politics/2019/10/15/fact-check-trump-lowered-taxes-for-middle-class-americans/

- https://www.breitbart.com/economy/2021/03/25/fact-check-joe-biden-claims-nearly-all-trump-tax-cuts-went-to-the-wealthy/