SEC Drafts Climate Change Disclosure Rule to Force Corporate Policing

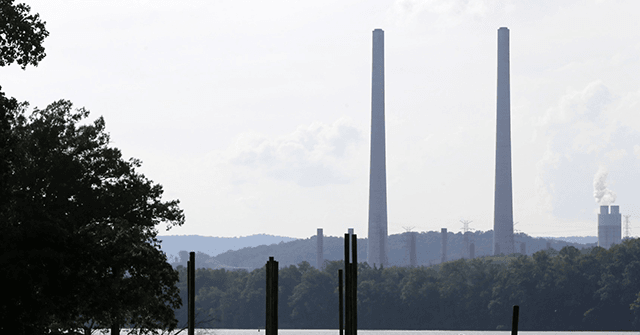

Joe Biden’s Securities and Exchange Commission (SEC) has issued a sweeping rule that would require public companies to disclose not only their own greenhouse gas emissions but also the emissions of customers and suppliers.

The Associated Press reported: Under the proposals adopted on a 3-1 SEC vote, public companies would have to report on their climate risks, including the costs of moving away from fossil fuels, as well as risks related to the physical impact of storms, drought, and higher temperatures caused by global warming.

They would be required to lay out their transition plans for managing climate risk, how they intend to meet climate goals and progress made, and the impact of severe weather events on their finances...

The required disclosures would include greenhouse gas emissions produced by companies directly or indirectly — such as from consumption of the company’s products, vehicles used to transport products, employee business travel and energy used to grow raw materials. U.S. SEC proposes companies disclose range of climate risks, emissions data https://t.co/khl53QeT8u pic.twitter.com/AqySdcyvOD — Reuters (@Reuters) March 21, 2022 “This proposal will be the light in a pathway toward addressing President Biden’s priority of disclosing climate risk to investors and all areas of our society,” Tracey Lewis, a policy counsel at Washington-based advocacy group Public Citizen, told Reuters. “There will be a lot of critics. People are going to try to tear it down, even probably from the left.” Critics say the methodology to make emissions calculations isn’t clear and that it could harm industries, specifically the energy sector. “The U.S. oil and natural gas industry has a long history of sustainability reporting, and achieving greater comparability and transparency across those efforts is a leading priority,” American Petroleum Institute’s (API) Senior Vice President of Policy, Economics and Regulatory Affairs Frank Macchiarola, said in a statement. “We are concerned that the Commission’s sweeping proposal could require non-material disclosures and create confusion for investors and capital markets.” “As the Commission pursues a final rule, we encourage them to collaborate with our industry and build on private-sector efforts that are already underway to improve consistency and comparability of climate-related reporting,” Macchiarola said. Reuters noted court challenges would probably focus on the SEC not having the legal authority to require Scope 3 emissions data.

The proposed rule is tied directly to the Environmental, Social, and Governance, or ESG movement, that seeks to rate American businesses on social and environmental issues, in turn pressuring businesses to take certain stances and actions to attract investors. Last year $649 billion went into ESG funds, according to Reuters, which said investors want more climate change data.

The draft proposal will be open for public feedback and could be finalized later this year. Follow Penny Starr on Twitter.

Read the full article at the original website

References:

- https://www.pbs.org/newshour/economy/sec-proposes-new-rules-for-companies-to-monitor-climate-risks#:~:text=Under%20the%20proposals%20adopted%20on,temperatures%20caused%20by%20global%20warming.

- https://t.co/khl53QeT8u

- https://t.co/AqySdcyvOD

- https://www.msn.com/en-us/money/markets/us-sec-set-to-unveil-landmark-climate-change-disclosure-rule/ar-AAVjHoz

- https://www.api.org/news-policy-and-issues/news/2022/03/21/api-statement-on-sec-proposed-climate-disclosure-rule