Some academic actuaries say we are not overestimating climate and biodiversity risks

Ed Note: This piece previously appeared on interest.co.nz. It is published here with the permission of the author. Some actuaries at the University of Exeter in the UK have partnered with a group of earth scientists to examine what they ter

Ed. Note: This piece previously appeared on interest.co.nz. It is published here with the permission of the author.

Some actuaries at the University of Exeter in the UK have partnered with a group of earth scientists to examine what they term “planetary solvency.” Their report states:

“Planetary Solvency assesses the ongoing ability of the Earth system to support our human society and economy. In the same way that a solvent pension scheme is one that continues to be able to provide pensions, a solvent Earth system is one that continues to provide the [natural]services we rely on, support ongoing prosperity, and a safe and just future.”

One might assume that the International Panel on Climate Change (IPCC) and the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) have undertaken such an assessments. According to the actuaries, these international bodies have grossly underestimated the risks involved from global heating and biodiversity loss. They state:

“Unmitigated climate change and nature-driven risks have been hugely underestimated….Global risk management practices for policymakers are inadequate, we have accepted much higher levels of risk than is broadly understood.”

Why the huge discrepancy between what the IPCC and IPBES have assessed as risks, and what the actuarial professionals conclude? Given that the issue is the capacity of earth systems to support a complex civilization, this is a question of considerable importance.

The actuarial report points out that the IPCC and IPBES rely predominantly on science rather than rigorous risk management methodologies. Risk management approaches are science-based, but they integrate additional practical ways of dealing with uncertainty and risky outcomes.

Science is concerned with precise measurements and establishing underlying laws of nature. Science appropriately requires a lot of healthy scepticism and replication to achieve a high level of consensus within the scientific community. These are clearly important ways of understanding the world.

However, the scientific methods that provide a high level of precision and certainty are not equipped to analyse and manage risks that may be low probability but have catastrophic impacts. This is what actuaries do.

Actuaries assess uncertainties in a rigorously methodical manner to understand how the worst outcomes might develop. By focusing on the extreme outcomes, they bring prudence into the decision-making process, to ensure that even the extreme risks are manageable. Their analyses allow policy makers to knowledgably understand uncertain risks, and develop policies to avoid disasters.

For example, European insurance companies are required to have policies in place that ensure they will not go insolvent any more often than once in 200 years. The chance of insolvency in any one year is thus set at 0.50%.

Such a low level of risk appetite seems appropriate for the financial security of the insurance company and its millions of clients.

This low level of risk tolerance is in contrast with the IPCC emissions targets for avoiding a 1.5 to 2-degree Centigrade increase in global heating. The IPCC target provides a 50% chance of avoiding a 2 degree C increase over preindustrial levels. This is 100 times riskier than the chance of a European insurance company going insolvent, and more than 1000 times riskier than a nuclear power plant failure.

In a separate actuarial report, the IPCC level of risk tolerance is clearly deemed “unrealistic.”

Another reason cited for the inadequate risk assessment carried out by the IPCC is that it focuses on what is perceived as most likely. Again, this is how science works. It bases conclusions on accumulated evidence and gathers more to increase precision and certainty. In contrast, risk management takes the worst possible outcome associated with an agreed risk tolerance, even if that outcome has a low probability, and ensures that outcome is avoided.

A related reason cited for the large discrepancies between sound risk management practices and what the IPCC does, is the frequency of updating risk probabilities. Because good risk management practices involve focusing on extreme but low probability outcomes, there is a frequent reassessment and updating of risk levels. It assesses whether the latest best evidence increases or decreases risk levels, so that policy actions can be adjusted.

The IPCC process set the above target in 2018 and it has not been updated since. This, despite considerable evidence that global heating is accelerating much faster than previously estimated.

Another major difference is what is included in the assessment. The science on ecological tipping points is clear in terms of their presenting potentially catastrophic risks. However, because science has not yet achieved precision regarding what level of global heating will trigger tipping points, or precisely what their impacts would be, they are not included in the IPCC assessments. Science is conservative, but not necessarily prudent.

The actuarial approach to risk management is not anti-science. Rather, it builds on the scientific evidence to understand consequences, and to direct policy. But it does understand the limitations of such research for timely policy initiatives. If definitive evidence is not available, the risk management approach can still make use of expert judgement, and assess consequences, especially if they are severe.

Waiting for the certainty provided by science may well make appropriate action too late to avert disaster. The actuarial report indicates this is what may be happening with our global attempt to deal with the climate and biodiversity threats we currently face.

There is more in the actuaries’ report to understand about the inadequacies of our current assessments of climate risks. More importantly, they identify a number of steps that could be taken to provide a more realistic assessment of the risks we face regarding planetary solvency.

The report states:

“The choice is simple: continue to be surprised by rapidly escalating and unexpected climate and nature-driven risks, or implement realistic Planetary Solvency risk assessments to build resilience and support ongoing prosperity. We urge policymakers to work with scientists and risk professionals to take this forward before we run the ship of human progress aground on the rocks of poor risk management.”

Here are just a few of the recommendations the report makes along these lines.

- Establish an independent organisation to conduct annual planetary solvency assessments to inform timely decision making

- Ensure policy makers are climate, risk and ecologically literate; this applies not only to international institutions, but to policy makers are all levels

- Consider systemic risks across a broad range of issues, including economic, climate, ecological and social, including how risks in one area affect risks in other areas.

- Identify the biggest risks, not out of gloom and doom, but prudence

- Make use of expert judgement when the science isn’t certain.

The report also identifies a list of resilience principles to be used in conducting a planetary solvency assessment. These tools provide a much more realistic and prudent risk understanding for policy makers to ensure the worst earth systems’ impacts are averted.

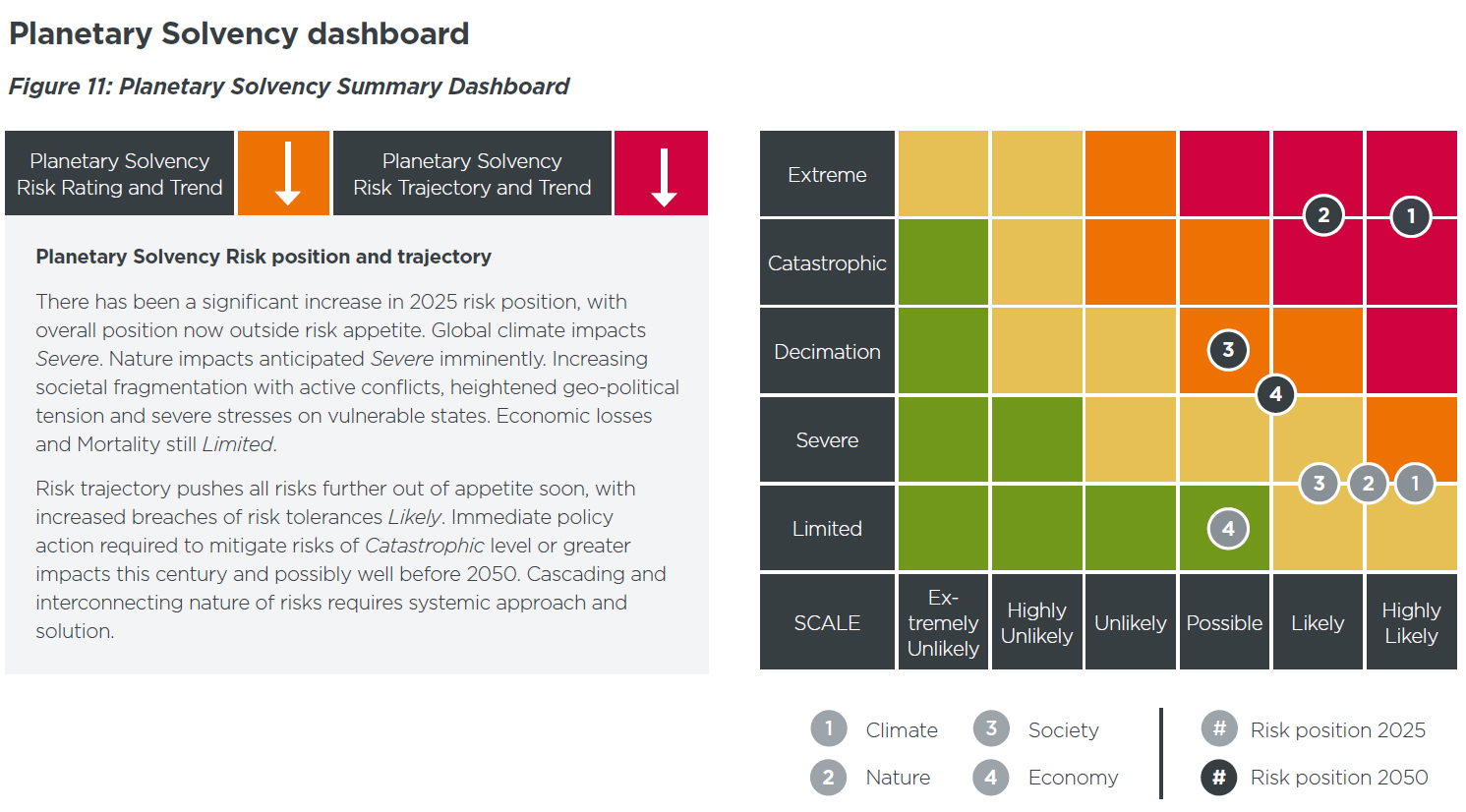

The earth scientists and actuaries involved in producing this report included a planetary solvency assessment based on their understanding of the situation we face. Their analysis indicates that we are currently outside the risk tolerance (green space) for all areas other than Economy.

The situation projected for 2050 ranges from Decimation for Economy, and Extreme or Catastrophic for all other areas.

These results project a reduction in GDP (a US$10 trillion loss), 2 billion deaths, and significant social and ecological breakdown by 2050, unless rapid policy changes are implemented.

Perhaps we should listen to the actuaries, one of the most conservative, and prudent, groups on the planet.

Read the full article at the original website

References:

- https://actuaries.org.uk/news-and-media-releases/news-articles/2025/jan/16-jan-25-planetary-solvency-finding-our-balance-with-nature/

- https://actuaries.org.uk/media/gebdhxzi/climate-emergency-final-report.pdf

- https://www.tandfonline.com/doi/full/10.1080/00139157.2025.2434494

- https://report-2023.global-tipping-points.org/

- https://bsky.app/intent/compose?text=Some%20academic%20actuaries%20say%20we%20are%20not%20overestimating%20climate%20and%20biodiversity%20risks+https%3A%2F%2Fwww.resilience.org%2Fstories%2F2025-03-04%2Fsome-academic-actuaries-say-we-are-not-overestimating-climate-and-biodiversity-risks%2F

- https://x.com/intent/tweet?text=Some%20academic%20actuaries%20say%20we%20are%20not%20overestimating%20climate%20and%20biodiversity%20risks&url=https%3A%2F%2Fwww.resilience.org%2Fstories%2F2025-03-04%2Fsome-academic-actuaries-say-we-are-not-overestimating-climate-and-biodiversity-risks%2F

- https://www.linkedin.com/shareArticle?url=https%3A%2F%2Fwww.resilience.org%2Fstories%2F2025-03-04%2Fsome-academic-actuaries-say-we-are-not-overestimating-climate-and-biodiversity-risks%2F&title=Some%20academic%20actuaries%20say%20we%20are%20not%20overestimating%20climate%20and%20biodiversity%20risks&summary=Why%20the%20huge%20discrepancy%20between%20what%20the%20IPCC%20and%20IPBES%20have%20assessed%20as%20risks%2C%20and%20what%20the%20actuarial%20professionals%20conclude%3F%C2%A0%20Given%20that%20the%20issue%20is%20the%20capacity%20of%20earth%20systems%20to%20support%20a%20complex%20civilization%2C%20this%20is%20a%20question%20of%20considerable%20importance.&mini=true