W.H. Economic Adviser Won't Rule Out Biden Minimum Tax Being First Step to Further Tax Hikes

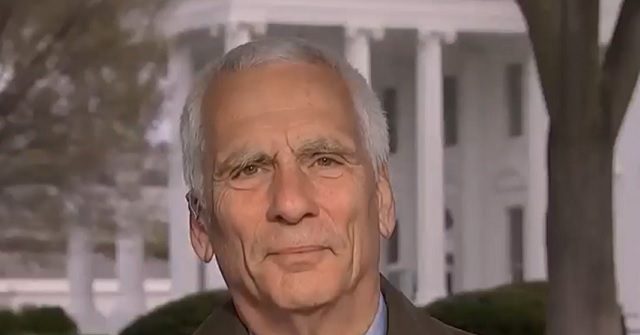

On Monday’s broadcast of MSNBC’s “Hallie Jackson Reports,” White House Council of Economic Advisers member Jared Bernstein responded to a question on whether the minimum tax proposal in President Joe Biden’s budget is a first step towards further tax increases by stating that the proposal “injects a huge dose of fairness into the tax code,” which is important to Biden, and is historic legislation “to try to figure out how we can fix this problem that billionaires tend to pay an effective tax rate of 8%.” Host Hallie Jackson asked, “Let me start with this new minimum tax for very rich Americans, which the White House says would apply to people, I think with more than $100 million basically. Is this just a first step towards potentially raising taxes on a bigger group of rich people, of wealthy Americans, or is this it for the moment?” Bernstein answered, “Well, I think what this is is an absolutely historically unique piece of tax legislation, the idea of which is to do something that’s really never been done in U.S. tax policy, which is to try to figure out how we can fix this problem that billionaires tend to pay an effective tax rate of 8%. I didn’t leave off a number there, 8%, below 10%, below what a firefighter or a teacher pays, in many cases. And that’s because our tax system leaves wealth out of its base and this billionaire’s minimum tax disallows that and it requires billionaires, the top .01% of the income scale to pay, at a minimum, a 20% tax rate, not the current 8%, raises 360 billion over 10 years, and injects a huge dose of fairness into the tax code, very important to this president.” Follow Ian Hanchett on Twitter @IanHanchett.

Read the full article at the original website

References: